Cache Listwithclever.com Real-estate-blog How-to-negotiate-realtor-commission

Should you try to negotiate realtor fees? | How commissions work | How much agents make | Factors that affect your rate | Negotiating tips and tricks | Find average commissions in your state | More ways to save

Are real estate commissions negotiable?

Realtor fees are technically always negotiable, regardless of what an agent or broker might tell you. But your ability to negotiate a lower rate — and how much lower — may depend on a variety of factors, including your property, demand in your area, the agent's relationship with their brokerage, and more.

Be aware that negotiating realtor fees can be tough! Even if you do manage to talk your agent down, it may not be the big price reduction you were hoping for.

If commission savings are a top priority, you're in luck! There are companies that actually negotiate reduced rates on your behalf — for free.

For example, Clever Real Estate pre-negotiates low commissions with full-service agents from top brokerages nationwide. On average, sellers save $9,000 on realtor fees when they list with Clever — no negotiating required.

» SAVE: List with a top agent in your area for just $3,000 or 1%

Or keep reading to learn more about the various ways to get a lower commission rate so you can weigh your options and take the path that makes the most sense for you.

Should you negotiate realtor commission?

Absolutely! Selling a house is expensive, and realtor fees are one of the largest associated costs. Even a minor fee reduction could save you thousands.

There's no set fee that all real estate agents charge — that would be price-fixing — but the current average commission rate nationwide is approximately 5.45%.

For a $346,800 home sale — the current median home value in the U.S.— that would translate to roughly $18,900 in realtor fees.[1]

Sticking with the above example, were you to negotiate a point, or 1%, off your commission, you'd save over $3,500. If you can knock off 2%, your savings jump to $6,900. That's real money!

Don't be afraid to initiate a pricing conversation!

Most agents are used to having conversations about compensation and will be open to negotiating rates.

In fact, a recent Zillow study found that approximately 31% of home sellers attempt to negotiate terms with their listing agents — and about 57% are successful.[2]

The marketplace is becoming increasingly competitive, as more agents compete for fewer listings.

Additionally, discount services like Clever and Redfin, with built-in low rates, are continuing to gain market share and reshape consumer expectations about what a realtor's services should cost.

As a result, many agents and brokers are becoming increasingly flexible on pricing and service structures — particularly when looking to attract sellers with desirable properties in high-demand markets.

Always shop around for the best price!

There are a ton of options — different brokerages, agents, discount services, etc. — out there to choose from. Be patient and do some research!

With a little legwork, you'll be able to find a great agent who's willing to negotiate the specific terms you're looking for.

We recommend shopping around and interviewing at least three agents and/or brokers to find the best overall value and fit.

» MORE: Find top local agents, compare your options, and choose the best fit

Potential challenges to negotiating a lower commission

Realtor fees are always negotiable — at least on paper. But in practice, not all agents will actually have the ability to lower their own rate.

Many brokerages dictate commission structures — particularly for newer agents — meaning that an agent may not be able to lower their rate, even if they want to.

✍️ Editor's note

If you're looking to negotiate fees, a more established agent may have more sway and control over their fee; however, it may be hard to convince them to budge on price!

Top agents with lots of experience know their worth — and are typically in high demand. This makes them less likely to be flexible on price than a hungry up-and-comer looking to establish themselves.

To reiterate an earlier point, you never know unless you ask. Even experienced agents may be willing to offer significant reductions under the right circumstances.

Don't be shy about initiating the conversation! Worst case they say no — best case you come away from the sale with thousands more in your pocket.

Remember: your agent has a bottom line to look out for!

When entering into price negotiations with an agent, keep in mind that the deal has to make sense for them too, from a financial perspective.

Being a real estate agent isn't cheap, and lowering their rate too much could result in them actually losing money on your sale.

Newer agents in particular have to share a large portion of their commission with their parent brokerage, so they likely have slimmer margins to play with than seasoned vets and/or independent agents who run their own brokerages.

At this point, it makes sense to offer a quick crash course on how real estate commissions work. Read on to learn what agents typically earn on a sale so you have that context coming into your negotiations.

How do real estate commissions actually work?

In a conventional real estate transaction, the total commission rate — we'll use 6% to make things easy — is typically split down the middle between two agents:

- The listing agent, who helps the seller market their home

- A buyer's agent, who brings one of their clients to purchase the home

The seller usually pays both agents' fees — or more accurately, they're baked into the home's price and come out of the seller's proceeds.

This allows buyers to cover the cost of their agent with their mortgage instead of paying the full price out of pocket.

| Fee | Rate | Cost* |

|---|---|---|

| Listing agent's fee | 3% | $12,000 |

| Buyer's agent fee | 3% | $12,000 |

| Total | 6% | $24,000 |

| *Based on $400,000 home | ||

Savings typically come from the listing agent's fee — not the buyer's agent fee

When you negotiate a lower commission rate, the buyer's agent fee typically stays the same. It's generally your listing agent who agrees to take a smaller slice of the overall pie.

So, using the above example, a 1% reduction might break down like this on a $400,000 home:

| Fee | Rate | Cost |

|---|---|---|

| Listing agent's fee | 2% | $8,000 |

| Buyer's agent fee | 3% | $12,000 |

| Total | 5% | $20,000 |

Offering a full, competitive buyer's agent commission is important to incentivize other agents to show your home. It maximizes the chances you'll be able to sell fast and for the best possible price.

How much does a realtor make on a home sale?

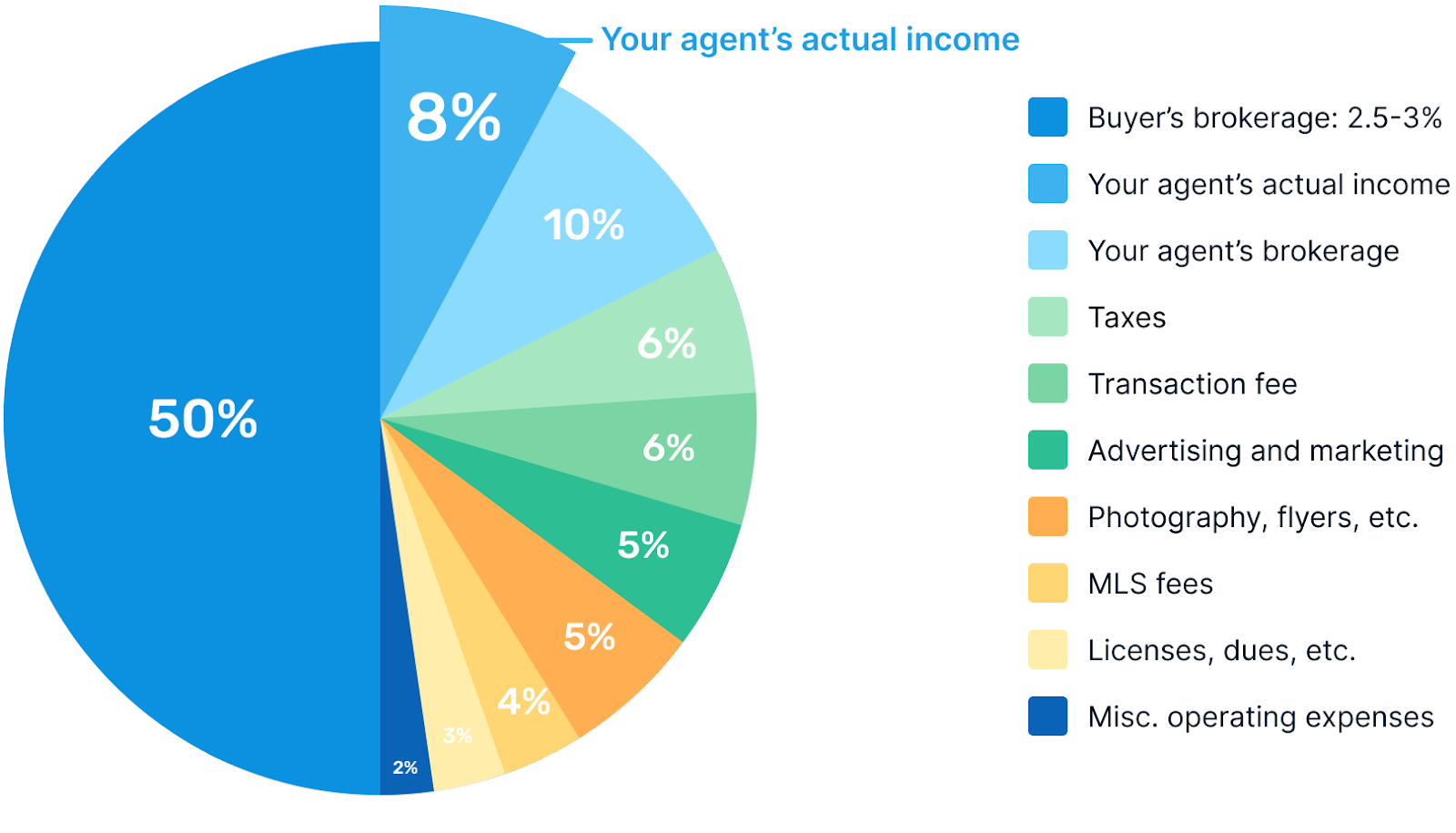

Sticking with the above example, both agents clear approximately $12,000 when they earn a 3% commission — on the surface, not too shabby. However, each agent has to split a portion of their respective fee with their broker.

Commission splits depend on the brokerage and agent's status within it. But newer agents might have to split as much as 50% of their take.

So out of a $24,000 total commission, the listing agent might only personally net about $6,000.

» MORE: How much do real estate agents make on a home sale?

Agents also have a lot of expenses to cover

Some agents simply won't have much room to come down on price, even if they wanted to, if they hope to turn a profit on the sale.

Keep in mind the agent likely covered a number of out-of-pocket expenses during the sale — professional photography, 3D tour, staging, and other marketing costs.

Agents also invest a ton of personal time into both finding new customers and getting the home sold, which represents a real cost.

To top it all off, most agents are independent contractors. They're typically responsible for self-employment taxes and recurring fees for MLS access, their real estate license, association memberships, office space, and more.

It's not unusual for an agent to put half their net commission towards taxes and overhead. The final amount of money that actually goes into their pocket could be an eighth, or less, of the total commission.

By understanding what an agent's financial situation looks like, you can be realistic when you're negotiating realtor fees.

⚖️ Discounted fees affect your agent more than they affect you!

A one-point reduction on a 6% total commission fee will net you about 16% in savings, all said and done. But that 1% reduction to the total fee means your listing agent will actually lose out on about 33% of their potential revenue, assuming a 50% split with their parent brokerage.

Factors that can affect commission rates

There are a number of factors that may play into your quoted rate — and how much leverage you may have in negotiating a lower one.

Price point

The higher your home's price, the easier it will be to negotiate a lower rate. Luxury homes typically pay lower rates regardless, no negotiating required. A small slice of a $1,000,000 pie is still a lot bigger than a full slice of a $250,000 pie — but both may take the same amount of time and effort to sell.

Local buyer demand

If you're in a hot market where properties are selling within 1-2 days, regardless of their condition, agents may be more open to a lower rate. After all, time is money — the faster your home stands to sell, the less time and effort the agent will have to invest.

Desirability of home

In a similar vein, if you have a highly desirable home, an agent may be more motivated to lower their rate to secure your listing. Conversely, if your home seems like it'll be hard to sell — it's in disrepair or a bad location, has an eccentric layout, etc. — the agent is assuming more risk and may be less willing to budge on price.

Time of year

In the off-season or low-inventory markets, when new listings are hard to come by, agents might be willing to lower their rates to secure new business because they need work and are in lower demand.

Agent experience

Newer agents may be willing to drop their rates — assuming their broker allows it — to boost their sales numbers and reputations.

Conversely, experienced agents will likely have more flexibility. But they may be less inclined to negotiate because they know their worth and are in high demand.

How to negotiate realtor commission

Before we get into specific tips on negotiating realtor commission, it's important to stress you should always approach a prospective agent — and negotiations in general — in a respectful and considerate manner.

Remember, you're relying on your agent to guide you through a complex, high-stakes — and stressful — process. Don't get things started off on a sour note!

🤝 Always aim for a mutually beneficial outcome!

The purpose of negotiating isn't to "win," per se. It's to find the most mutually beneficial terms possible for both parties involved. Instead of asking only for concessions, consider how you'll add value to the partnership as well!

Jump to a negotiating tip

- Evaluate your negotiating leverage

- Find your area's average commission rate

- Shop around for the best value

- Make your house easier to sell

- Create value for the agent

- Offer a full buyer's agent fee

- Work with an up-and-comer

- Sell and buy with the same agent

- Let your agent represent you and the buyer

- Be prepared to walk away!

Determine how much negotiating leverage you have

Get a good idea of how much leverage you have based on the factors we discussed in the previous section.

In particular, pay close attention to:

- How much demand there is for homes like yours in your area

- What homes like yours have recently sold for in your area

- How much your agent stands to earn based on your target rate and price

Know the average commission rate in your area

The nationwide 5.45% total commission rate average puts the typical listing fee rate in the 2.7% range — but of course, this number will vary from market to market.

For example, the average commission rate in Missouri (6.07%, as of this writing) is approximately 17% higher than in New Jersey (5.17%).

Knowing what's typical in your area will give you a good baseline for your negotiations to ensure both parties are keeping requests reasonable.

» MORE: Find the average commission rate in your area

Shop around for the best possible value

There is a huge number of real estate agents and brokerages out there to choose from — and every one of them is different.

Some will be totally inflexible on price, whereas others will be open to getting creative about tailoring fee and service structures to suit your specific needs and goals.

Others — specifically discount brokers and agent-matching services — offer built-in commission savings, no negotiations required (though there may be service-quality tradeoffs…)

The point is this: Do your homework to find the right agent or service for you! We recommend interviewing at least 2-3 options to find the best fit — in terms of price point and customer service — for your specific needs and goals.

Try Clever's free agent-matching service!

Interview top agents, find the perfect fit, save thousands.

Offer to invest in things that make your house easier to sell

Agree to make recommended pre-listing repairs and improvements, such as repainting, doing some landscaping, cleaning the carpets, and so on.

If you're willing to put up some cash to make your agent's job easier, they may be willing to lower their rate in return.

If you want to take it a step further, you can pay for a pre-listing inspection. This will help surface any previously unknown issues that could prolong or derail negotiations.

Consider how you can create value for the agent

Selling a house is an involved and complicated process. Agents not only have to invest a considerable amount of their personal time — but they also typically cover a number of upfront costs, such as professional photos and marketing expenses.

When negotiating rates, look for ways that you can help reduce those upfront costs or bring some kind of value for the agent to sweeten the deal.

Maybe you don't care about Open Houses or 3D tours, or you have a friend who's a professional photographer who can take care of the images for the listing.

Keep in mind that the agent is looking to sell your home fast and for the best possible price. If you're trying to net savings by jettisoning important services that may make it harder for them to succeed, they might have second thoughts about working with you at all.

Offer the full, recommended buyer's agent fee

Offering a competitive buyer's agent fee is key when it comes to getting homes sold fast and for the best possible price.

📢 Don't skimp on buyer's agent commission!

Approximately 90% of buyers work with an agent. When you don't offer a competitive buyer's agent commission, agents will, at the very least, deprioritize showing your home — if not steer their clients away from it entirely (even though that's technically illegal, it still happens!).

Unless you or your agent have a buyer lined up coming into the sale, a low — or no — buyer's agent commission is going to significantly reduce your prospective buyer pool and make it harder to sell your home.

Knowing this, your agent likely won't be open to lowering their rate, as they're assuming more risk in taking on a listing that may take longer to sell — or fail to sell all together.

Consider working with an up-and-comer

Newer agents may be more open to working for lower rates, as they're often more concerned — at least in the short term — in growing their reputation by bolstering their sales numbers, positive reviews, and word-of-mouth referrals.

Of course, as we already discussed, newer agents' rates are often dictated from on high, by their brokerage, and they may not have much sway or ability to lower them.

Additionally, there are some obvious tradeoffs that come with working with a newer agent over a top-producer with tons of experience, local market expertise, and a robust professional network.

Offer to sell and buy with that same agent

As a one-time customer, you represent a single paycheck opportunity for an agent, which gives you limited negotiating power.

But when you agree to sell and buy up front, you're now a repeat customer. The agent is earning more money without having to invest additional resources into picking up that second transaction.

As a result, the agent may be willing to lower their rate to secure both deals. They're earning a lower commission on the home sale, but more money overall because they're collecting a fee on both transactions.

Let your agent represent you and the buyer

When a single agent represents both parties in a real estate transaction — known as "dual agency" — it's common for them to lower the total commission rate as they're collecting both sides of the fee, known as "double-ending" a deal.

This typically occurs when you find your own buyer or an unrepresented buyer approaches the agent or their brokerage about your listing directly.

Dual agency lowers the overall cost of the transaction and, therefore, can benefit all parties. However, it also poses some significant risks and conflicts of interest for both the buyer and seller. For this reason, dual agency is actually illegal in eight U.S. states.

» LEARN: Everything you need to know about dual agency

Be prepared to walk away if necessary!

The goal of any negotiation is to reach a mutually agreeable outcome that benefits all parties involved — but you also should be willing to walk away if the other party is unwilling or unable to give you what you need for the deal to make sense.

That said, before you draw a line in the sand and declare something is a dealbreaker, make sure you're actually ready to walk the walk. If you're bluffing and the other party calls it, chances are they'll feel like they can push even harder — and your chances of getting an outcome you feel good about are significantly lower.

More ways to save on realtor commission

Depending on your market and property, you may not be able to negotiate a lower rate with agents. Consider these cost-saving alternatives instead.

Agent-matching services with built-in savings

Consider finding your realtor through an agent-matching service that negotiates discounted rates, like Clever Real Estate.

The best agent matching services are 100% free to use and only work with top-rated, full-service agents; however, not all will negotiate commission savings on your behalf.

For example, Clever matches you with top-rated local agents from major brands and top regional brokerages who have agreed to offer Clever customers full service for a fraction of their typical rates:

- Flat $3,000 listing fees for homes under $350,000

- 1% listing fees for homes over $350,000

Clever provides a steady stream of new business at zero upfront cost, which allows agents to charge less and still net a profit.

» SAVE: Work with a top agent, get full service, save thousands

Hire a discount real estate broker

Discount real estate brokers offer in-house agent teams that offer many of the same services as traditional agents at a significantly lower price point.

Because most make up for their discounted rates by handling a higher volume of business per agent, there are often additional risks and service-quality tradeoffs.

The type and degree of risk varies by company, as each has its own "secret sauce" for creating savings — and some are more effective than others.

» MORE: The ultimate guide to discount real estate brokers

Sell for sale by owner (FSBO)

Listing your home FSBO means you're handling the entire sale yourself, without the help of a real estate agent.

The potential upside is BIG savings! You get to hang onto an additional 2.5-3% of your home's sale price — possibly more if you're able to find an unrepresented buyer and avoid paying the typical 2.5-3% buyer's agent fee.

However, there are a number of BIG downsides as well. Selling a house is a hugely complex and involved process. Unless you have a ton of real estate experience and time to kill, your chances of getting the best possible price and terms — or selling your home at all — are relatively slim.

» MORE: How to sell your house for sale by owner

Hire a flat-fee MLS company

One of the biggest challenges for FSBO sellers is attracting qualified local buyers. Flat-fee MLS services can help increase your FSBO listing's exposure without breaking the bank.

A flat-fee MLS company will post your listing on your local MLS — the primary platform agents use to find properties for their clients — for a low, upfront fee.

You get increased visibility, but the benefits typically end there. You'll still have to manage the entire sale yourself, and you're on the hook for the fee whether your home ends up selling or not.

» MORE: What to know about flat-fee MLS listing services

Sell to a "We Buy Houses for Cash" company or investor

We Buy Houses for Cash companies and property flippers will typically buy any property — regardless of its condition or location — for cash.

A cash for houses company or property flipper may be a good option if you're:

- Looking to sell a distressed property and are unwilling or unable to pay to fix it up before listing — also known as an "as-is" sale

- Under pressure to sell quickly — e.g., in pre-foreclosure, immediately relocating for a job, facing a divorce

- Simply don't want to deal with the hassle and time-commitment of listing on the open market — i.e., maybe you inherited a property and are looking to turn it over fast

The big tradeoff is price. These companies and investors have to make low offers to ensure a decent profit on the flip. Expect to lose out on 40-50% of the home's market value in exchange for that convenience.

» MORE: We Buy Houses for Cash companies (the ultimate guide)

Sell to an iBuyer

iBuyers are companies that leverage technology to make fast-all cash offers on homes, often sight unseen.

These companies have strict criteria for the types of homes they buy, but if your home qualifies, you'll get an initial cash offer within approximately one business day. You can then typically choose a flexible closing timeline — anywhere from 7-90 days.

Of course, there's a catch: iBuyers charge hefty service fees, ranging from 5-15%, in exchange for that convenience. Moreover, the most you're going to get for your home is its fair market value, whereas listing with an agent on the open market offers the opportunity to capitalize on demand and bid the price up even higher.

» MORE: Learn more about iBuyers

Cache Listwithclever.com Real-estate-blog How-to-negotiate-realtor-commission

Source: https://listwithclever.com/real-estate-blog/how-to-negotiate-realtor-commission/

Posted by: cruzagivery1969.blogspot.com

0 Response to "Cache Listwithclever.com Real-estate-blog How-to-negotiate-realtor-commission"

Post a Comment